Smarter Fraud Detection. Safer payments.

At FortiPay, we are reimagining digital fraud prevention — using intelligent systems, adaptive AI, and behavioral analytics to help businesses detect threats in real time, reduce false positives, and protect their revenue before it’s compromised.

Fraud is no longer just a cost of doing business — it's a strategic risk that erodes customer trust, destroys margins, and creates operational drag. And it’s evolving faster than many businesses can react.

Our Mission

At FortiPay, our mission is to empower businesses of all sizes to predict, prevent, and protect against digital fraud — before it impacts revenue, reputation, or customer trust.Built from the ground up to tackle the challenges of modern digital commerce, with a focus on speed, intelligence, and adaptability.

AI-powered Real-time risk scoring that evolves with every signal and transaction

Device intelligence and behavioral biometrics to identify bots, emulators, and synthetic users

Real-time chargeback prediction to help merchants stop disputes before they escalate

Dispute automation tools that generate compelling, card-brand-ready responses

FortiPay doesn’t just detect fraud — we give businesses the tools and confidence to stay ahead of it.

Digital Fraud Is Accelerating and Shifting

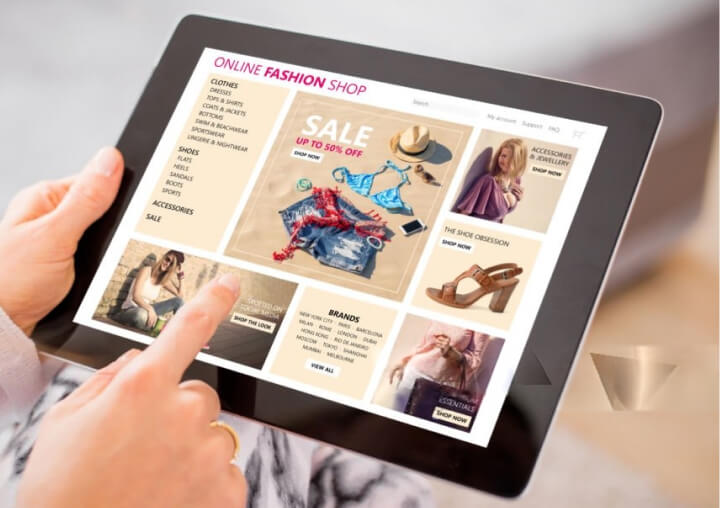

The rise of eCommerce, embedded finance, and digital payments has created powerful opportunities — and equally dangerous attack surfaces.

Today’s fraudsters aren’t lone hackers. They’re organized networks using bots, stolen credentials, and real-time scripting to exploit every gap in the transaction flow. And the data is staggering:

- $41 billion was lost globally to online payment fraud in 2022 — with projected losses reaching $48 billion by 2025

- eCommerce fraud alone grew 18% year-over-year in 2023, as fraudsters increasingly target fast-growing platforms with low oversight

- Refund fraud and chargeback abuse surged by 35%, creating tens of billions in lost revenue and operational strain for merchants worldwide.

- Account Takeover (ATO) attacks rose 354% from 2020 to 2023 — with fraudsters bypassing passwords and exploiting digital identity systems

- Industries like airlines, marketplaces, fintech, and crypto are experiencing fraud rates up to 5x higher than traditional commerce channels.

Our Solution

FortiPay is an AI-powered platform that stops fraud before it happens—preventing chargebacks, blocking fake accounts, and securing every transaction across online, mobile, and crypto channels.

Real-Time Fraud Detection

Instantly identify and block suspicious activity before it causes damage.

Identity Verification & Behavioural Analytics

Verify users and detect high-risk behaviour using smart, adaptive profiling.

Chargeback & Account Abuse Protection

Reduce costly disputes and fake transactions with proactive fraud defense.

Seamless Integration

Easily plug into your payment gateway, eCommerce platform, or custom system via API.

Crypto-Ready Security

Protect digital wallets, exchanges, and blockchain-based transactions with intelligent threat monitoring.

AI-Powered Protection

FortiPay’s advanced machine learning engine adapts in real time to detect and stop emerging threats—before they cause harm.

Why This Matters

Every dollar lost to fraud is more than lost revenue. It’s:

Lost Customer Trust

More Payment Disputes

Higher Chargeback Fees

Operational Bottlenecks

Lost Real Customers

Merchants today need fraud prevention that moves as fast as the threat itself.

Who We Work With

We proudly support a wide range of industries, including

Retailers & eCommerce Brands

Airline and travel industries

Payment Providers & Fintech Platforms

Marketplaces & SaaS Platforms

Government & Public Sector Organizations

Crypto platforms & digital asset

Partner with FortiPay

Join countless businesses trusting FortiPay to protect transactions and customers, working together to build a safer digital commerce ecosystem.

Our Story

FortiPay was founded by John Okanlawon, a former Interswitch Group employee who saw both the inner workings of one of Africa’s most advanced payment networks and the real-world challenges small businesses face every day.

At Interswitch, John developed deep expertise in digital payments, fraud systems, and financial infrastructure. But after moving to Canada, when his wife’s pizza shop began suffering from fake orders, chargebacks, and lost revenue, the problem became personal. It revealed a clear gap: while large enterprises have access to powerful fraud tools, small and mid-sized businesses are often left exposed.

That experience inspired the creation of FortiPay, short for Fortified Payments, an AI-powered fraud and identity protection platform built specifically for SMBs, FinTechs, and modern commerce. FortiPay delivers enterprise-grade security with speed, simplicity, and seamless API-first integration.

But we don’t just stop fraud, we help businesses reduce losses, build customer trust, and grow with confidence in a digital world full of risk.

Let’s make safer payments the new standard for everyone.

What You Can Achieve with FortiPay

Stop fraud in real-time

Block suspicious transactions before they’re approved

Protect customer trust

Minimize false positives and ensure a smooth experience

Reduce chargebacks and losses

Identify threats early and cut dispute costs

Grow with confidence

Scalable, API-ready, and easy to integrate

Secure crypto and traditional payments

One platform, all channels

Compliance & Data Privacy

FortiPay is more than just a fraud prevention tool — we’re your partner in secure growth.

Let’s build a safer economy — one secure transaction at a time..

Powered by FortiPay’s AI-driven fraud prevention and chargeback protection.